Hurricane Season 2022: Ian & Nicole Aftermath

written by Matthew Sengsourinh

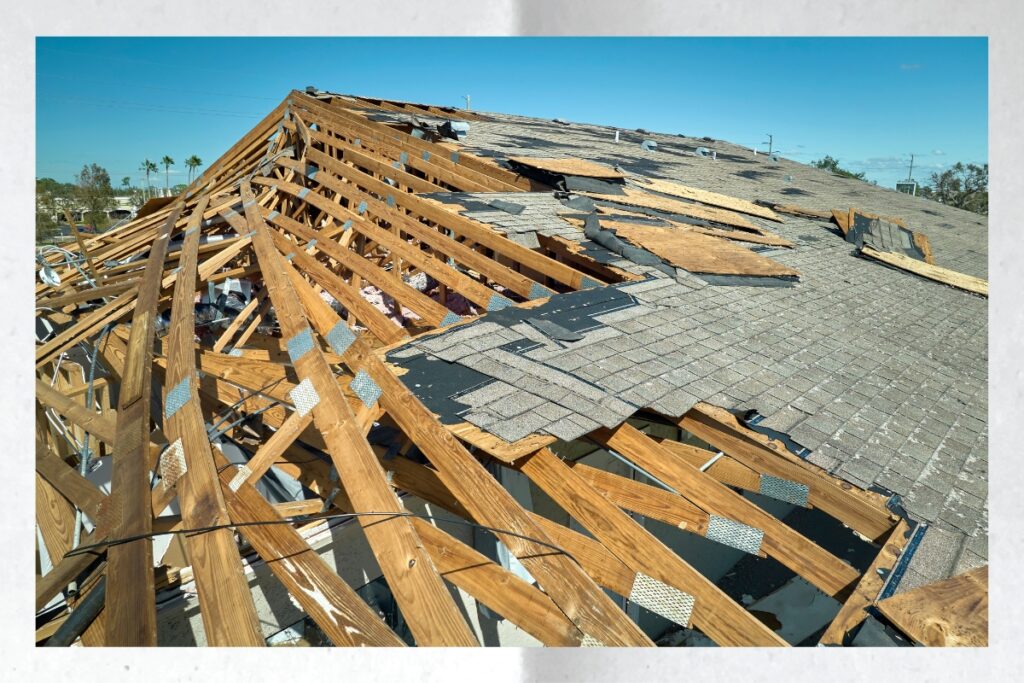

IN LESS THAN A MONTH, 65,475 HURRICANE IAN CLAIMS CLOSED BY INSURANCE COMPANIES CLAIMING THAT THE DAMAGES WERE BELOW DEDUCTIBLE. ONLY 7% OF HOMEOWNERS DAMAGED BY HURRICANE IAN HAVE FLOOD COVERAGE.

The number of closed claims is unprecedented given the size, strength and geographic area impacted by Hurricane Ian. This may be an indicator of how understaffed insurance companies are currently and these staffing issues may ultimately lead to a rise in litigation. Another contributing factor may be the trend toward higher deductibles and less coverage in to-day’s insurance products. For association’s impacted by Hurricane Ian and now, Nicole, it is a wakeup call and a reminder of your obligation, which is to prove damage. If it’s believed that your association’s claim is under deductible, but the Association disagrees, either the association didn’t prove its damages, or the insurer blamed the cause of the loss on something other than Hurricane, such as, wind driven rain. In either situation, it’s an important reminder to avoid try-ing to be an insurance coverage expert, buy proper insurance and most importantly, get representation.

Review the coverage matrix: unit owner v. Community Association insurable interest

This will serve as a reminder or a quick reference guide for Florida Statute 718 and its insurance parameters defining unit owner, limited common area, and common area insurable interests. However, this is subject to interpretation, change and often influenced by case law.

How to make an advance payment demand for Flood and Wind?

If you have suffered flood damage, make a demand for an ad-vance payment. However, exercise some patience and make a meaningful demand for immediate, emergency services. Avoid making a demand for only the amount of the flood deductible. For wind-related losses, exercise more patience and obtain credible estimations of your loss or damages. Trying to rush the demand for advance payment on a wind-related claim for an association earlier in the process may increase your chances of denial, underpayment and delays in your claim.

How to claim funds from FEMA for uninsurable damages?

For Hurricane Ian, the federal government has extended debris removal cost coverage from 30 days to 60 days. You have 60 days from the event to put in a FEMA request that can cover debris removal, a typically uninsurable loss. Debris removal includes landscaping debris removal, costs of garbage containers, etc. Associations able to file for this relief either through phone, physically at a FEMA Disaster Recovery Center, or online. Associations have reported having issues filing online, so it is recommended that you appear in person. Additional information can be found at: https://www.fema.gov/disaster/hurricane-ian or by phone: (800) 621-3362

Please note, the request requires personal information such as SSN and gross annual income. We advise against having a Manager or team member submit their personal information tying them to the request. We recommend making this information available to the Boards and have them submit the claim on the Association’s behalf, should they so choose. The management’s responsibility would be to collect all debris removal invoices, requesting landscaping or debris removal vendors to identify “Hurricane Ian Debris Removal” on the invoice (for claim identification), and any other cost consolidation for them. Addition-ally, the initial request does not allow for FEIN to be added. After a request and account has been created, the FEIN can be added to reflect what FEMA considers to be a business-related request. Please note, this is not a guaranteed cost recovery, only a potential, additional option. Within the link provided, you can also select “Find your nearest DRC” to identify your closest, in person FEMA location.

Why FEMA adjusters are demanding your signatures on documents that are not required by law or policy?

Be careful what you sign and who it is provided to. The NFIP policies require a Proof of Loss (POL) in order to receive payment. We are unaware of any other Federal laws or policy conditions that would require you to waive rights or swear to anything other than the amount of your damages stated on the Proof of Loss form. For hurricane Ian, FEMA extended the POL deadline for 365 days from September 26, 2022, however under normal circumstances a policyholder only has 60 days from the date of loss. If a policyholder fails to file a properly filled out POL with-in 60 days, it may waive all rights and entitlement to benefits.

How to deal with unqualified insurance adjusters, i.e. contingent workers?

Insurance Companies lack the resources necessary to adequately respond to a hurricane. The claim may be reassigned numerous time and these services are frequently outsourced to third parties that temporarily staff up to meet the needs of an insurance company. However, they don’t represent your interest. To protect the Association’s interests, ask the adjuster(s) represent-ing the insurance company for a copy of their valid adjusting license and check the Department of Financial Services office website to ensure they are registered and in compliance. Also, keep a diary of everyone you speak with including the date and time and mode of communication, i.e.: phone, email, or text. If an adjuster visits the property or conducts an inspection, record what happened, what they saw and what they said.

Claim reporting standards are in the policy – It won’t say the broker, contrary to popular belief?

Review the policy terms and conditions and look for the policy re-quirements to report a claim. Contrary to popular belief, for an As-sociation, the requirements typically stipulate that the claims must be made directly to a third party, someone other than the insurance company or the Broker. If you do not follow these provisions, your association’s claim may be denied. Also, look for the duties in the event of a loss section. Go ahead and print this section out to help remind you of what you need to do to comply with the Association’s obligations under the policy.